capital gains tax changes 2021

House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to. Experienced in-house construction and development managers.

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Connect With a Fidelity Advisor Today.

. The annual exempt amount for individuals and personal representatives remains 12300 for 202223 and the annual exempt amount for most trustees also remains. Because you only include onehalf of the capital gains from these properties in your taxable. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. A reduction in the annual level of Capital Gains Tax exemption could be. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Net capital gains from selling collectibles such as coins or art are taxed at a maximum 28 rate. Proposed changes to Capital Gains Tax Current CGT rate Proposed CGT rate. However it was struck down in March 2022.

The portion of any unrecaptured section 1250 gain from selling section. Track Clients Potential Tax Liability with Tax Evaluator. For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000.

On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. Finally as I said the rate preference is a hundred years old. Additionally a section 1250.

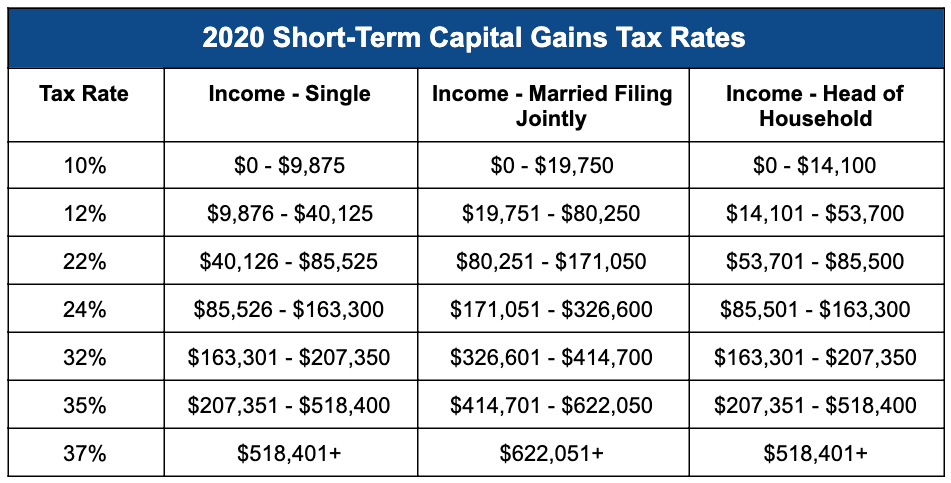

Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. Web-based PDF Form Filler. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets.

10 on assets 18 on property. The rate preference makes it better. This tax change is targeted to fund a 18 trillion American Families Plan.

ONS recommendations on Capital Gains Tax are. Ad Browse Discover Thousands of Book Titles for Less. Customers will continue to complete their tax return as now for any other Capital Gains Tax declarations in the future.

It should also be noted that the net investment income tax of 38 would be imposed in addition to the income tax resulting in a tax rate of 434 on capital gains for high earners. They will pay tax on any profit above their tax-free. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28.

Bring into line Capital Gains Tax with Income Tax. Taxing capital gains at regular rates would make the problem worse. Ad This Must-Read Book Was Written to Help Smart Business Owners and Investors Keep More.

Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. Once fully implemented this. 20 on assets and property.

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. Experienced in-house construction and development managers. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

This means youll pay 30 in Capital Gains. Ad Year-End Planning Resources To Help You Reallocate Capital For Tax Loss Harvesting. The 50 of the capital gain that is taxable less any offsetting capital losses gets added to your income and is taxed at your marginal tax rate based on your level of income and.

Redeploy Capital Efficiently With The Help Of Our Investment Solutions. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more. Ad pdfFiller allows users to Edit Sign Fill Share all type of documents online.

Edit Sign and Save Rental Property Statement Form. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. The rates do not stop there.

Capital Gains Trade Nears Potential Deadline As Legislation Looms

2021 Proposed Tax Law Changes Potential Impacts

Capital Gains Tax Archives Skloff Financial Group

How Are Capital Gains Taxed Tax Policy Center

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit

Estate Taxes Under Biden Administration May See Changes

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

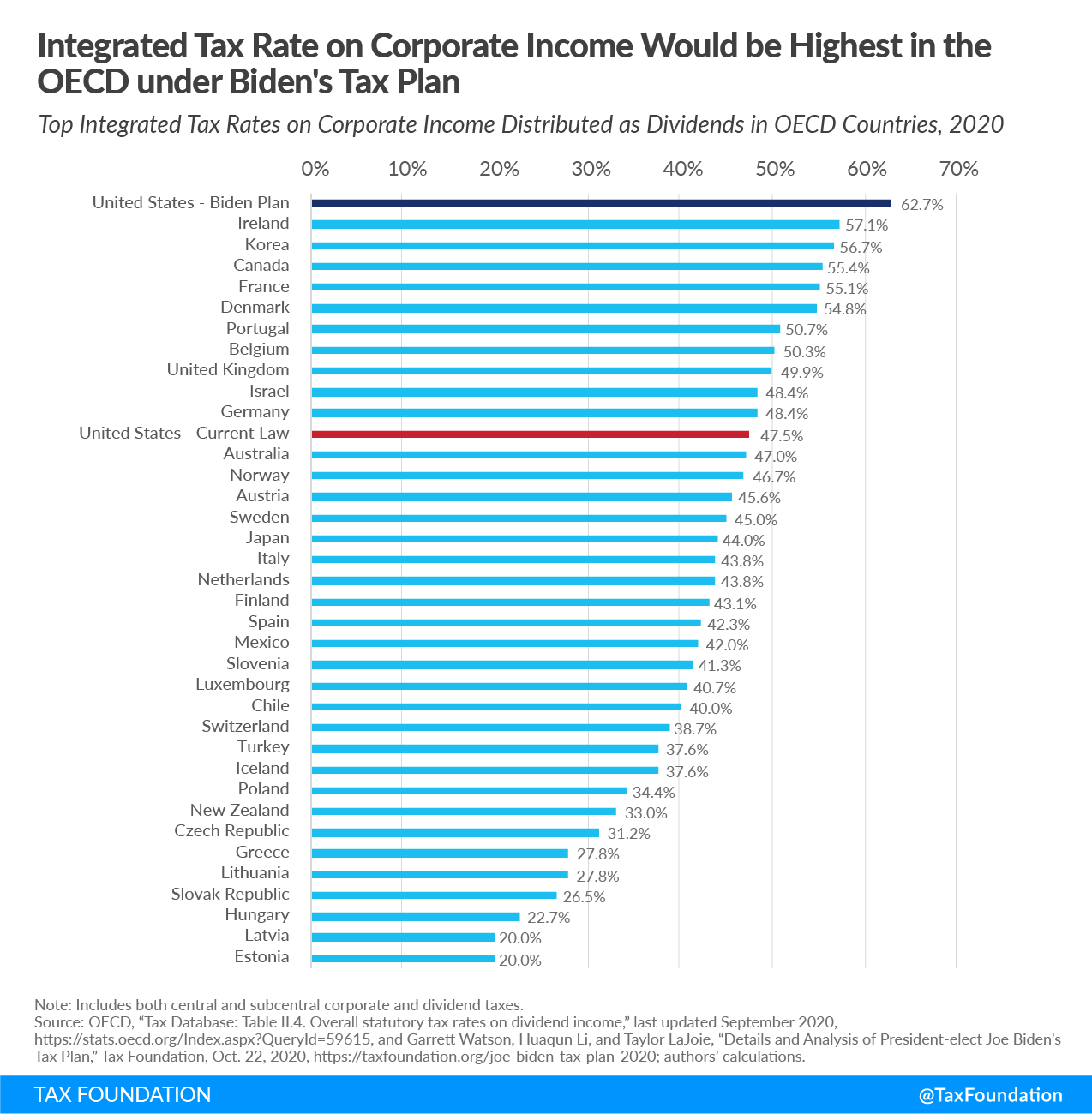

Tax Foundation On Twitter President Elect Joe Biden S Proposal To Increase The Corporate Tax Rate And To Tax Long Term Capital Gains And Qualified Dividends At Ordinary Income Tax Rates Would Increase The Top

Capital Gains Tax Sensitivity In A Goals Based Framework Glenmede

2022 Income Tax Brackets And The New Ideal Income

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

Managing Capital Gains Tax In 2021 And Beyond Ultimate Estate Planner

Capital Gains Full Report Tax Policy Center

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis

How Regular People Can Pay Less Taxes Like The Rich And Powerful

The Potential Biden Tax Changes What You Can Do About Them Aagla